And the prize goes to...

The winner of the Our Long Walk Essay Competition revealed!

Congratulations to Adam Gear, a 22-year old South African student, who is the first winner of the Our Long Walk Essay Competition.

As this was a first attempt at providing a platform for new ideas from across the continent, this was a steep learning curve. I was disappointed by the response rate. Despite an enormous (and costly) social media drive, we ultimately received only 30 entries that met the criteria (Africans below the age of 25). While some essays, like Adam’s, were excellent, most clearly relied heavily on LLMs for much of their content. The consequence is a superficiality that masks any good ideas the author might have.

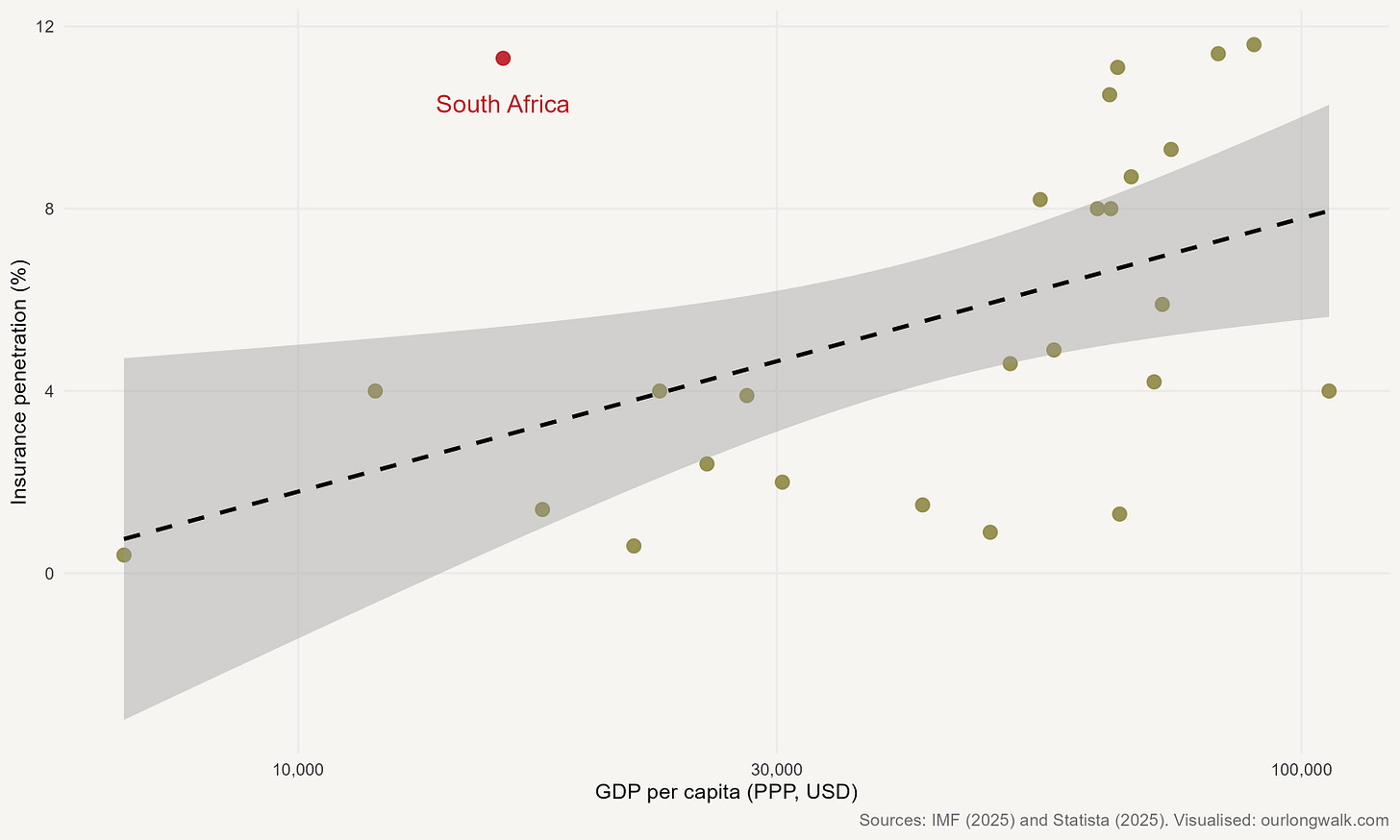

I also found that authors failed to make the topic their own. They wrote broadly about ‘innovation in Africa’ rather than focusing on one specific topic within that broad theme. This is where Adam stood out. His opening graph was the hook: exposing how the insurance industry in South Africa is an outlier if considered from a global perspective.

If I had to be critical, I would have loved Adam to explore the (historical) reasons for South Africa’s innovative insurance industry. But perhaps that can be a topic for a future post. To me it is far more valuable for an essay like this to identify a good question that to try provide a comprehensive answer.

Who is Adam Gear? Adam is currently studying a BSc Computational Finance with a minor in Mathematics at the City University of Hong Kong. In his spare time, he enjoys learning Mandarin, long-distance running/hiking, and reading news analysis on Substack. Adam explains that he decided to write about South Africa’s insurance industry after repeatedly encountering its influence domestically and abroad, through comments foreign friends had made to him while visiting South Africa, and because of his own original plan of studying actuarial science in undergrad.

There are other submissions worth mentioning. Trendys Gesare, Ewuradwoa Koranteng, Ben Anderson and Robyn Wangra all produced essays that I enjoyed reading (and will each receive a free copy of my book), but few had the focus that I found in Adam’s piece.

The hope is that this becomes an annual competition, though I will need to rethink both the criteria and the format to encourage more original, focused contributions. The prize money for this competition comes entirely from paid subscribers to Our Long Walk. If you value the idea of creating a platform for new African voices, please consider signing up for a paid subscription. Potential sponsors who wish to support this initiative and help amplify emerging talent across the continent are also welcome to get in touch.

With that, I am delighted to share Adam’s winning essay:

South Africa’s insurance innovation

Driving from OR Tambo International Airport to Sandton, the heart of Johannesburg’s business district, international visitors would immediately notice the sheer number of giant billboards crowding our highways, all selling one thing: insurance. Those same visitors might also be surprised to find that, to a South African, studying actuarial science is as prestigious as engineering or law, if not more.

And if that visitor dug deeper, they’d learn that the country has one of the world’s highest insurance penetration rate, a staggering feat for a middle-income country. As my figure below demonstrates, South Africa sits far above the global average and only marginally trails the United States and Taiwan.

Insurance is so ubiquitous in South Africa that you’d be forgiven for not noticing it. Some people probably avoid acknowledging the hold the industry has on us for what it says about our sense of risk. Indeed, it is probably South Africa's more negative characteristics, like its staggering inequality and persistently high rate of violent crime, that create such strong incentives toward insurance. As the state struggles to provide basic security, private insurance has become a safeguard and a status symbol. Rather than wait for the state to innovate, South Africans built parallel insurance systems to mitigate risk.

The root cause of South Africa’s insurance boom may be gloomy, but its result is not. Insurance has become a vital industry adept at mitigating systemic social fractures. Nevertheless, the story of South African insurance is far more extensive than its local footprint, and its story needs to be told.

Consider Hong Kong’s bustling promenade. Beneath the city’s towering skyscrapers, nestled right in the center of this cityscape overlooking the harbour, is a name familiar to any South African: Vitality.

Back home, this brand evokes 10,000-step targets, fitness watches, and Kauai smoothies. But few South Africans know the innovation at the heart of this household name.

Discovery, founded by Adrian Gore and Barry Swartzberg in 1992, revolutionised South Africa’s health insurance landscape by introducing the medical savings account. This innovation – now an industry standard – allows members to manage their day-to-day medical expenses while providing traditional insurance cover for major expenses, reducing the burden on both insurer and member.1 The company has since expanded its offerings as well as its footprint. Discovery’s flagship product, Vitality, has patented the idea of pricing insurance through behavioural tracking and rewarding members for healthy behaviours. Today, the Vitality Group has developed partnerships and operations, each implementing its behavioral-based insurance model in 20 jurisdictions across the world.2

And while this is the prime example of insurance innovation from South Africa, it is not an isolated case.

In 2004, MiWay’s First For Women targeted women as the key market, charging cheaper premiums commensurate with women’s lower road accident rate.3 While demographic-based insurance pricing had existed long beforehand, a business and marketing model centered around it was unique in South Africa.4 Following First For Women’s success, companies such as Sheilas’ Wheels popped up in the UK selling a strikingly similar model.

Naked Insurance, another South African insurer, was one of the first to pilot and scale on-demand, no-call-center insurance successfully. It was also the first South African insurer to provide an AI-based insurance product. Here customers can get an instant quote and purchase that insurance immediately, lowering the barrier to entry and making it easier to compare quotes.5 They’re also probably the “winners” of the competition for consumer attention, selling insurance as an exciting and interesting product.

These are just a few examples demonstrating South Africa’s innovative insurance industry. Indeed, as Pineapple Insurance co-founder Matthew Elan Smith commented about the American market, “America is less competitive than South Africa from an insurance perspective.”6

All the same, South Africa fails itself by underplaying its advantage in this field. Despite Naked’s best marketing efforts, insurance isn’t sexy.

When we picture African innovation, we often look for examples on the scale of Taiwanese semiconductors, American artificial intelligence, or European luxury brands. In search for these parallel industries, discussions of African progress default to mobile money or solar energy: worthy, but predictable and without the same impressive scale. Meanwhile, South Africa’s actuarial labs have quietly exported and sold novel insurance models, like that of Vitality, to the Global North. This is a big deal. Reporting by IBISWorld reveals that life and health insurance are the single largest industry by revenue in the world.7 Direct general insurance, on the other hand, is the seventh largest industry by revenue. If South Africa is the global center of insurance innovation, that is worth mentioning. It would mean that Africa is home to one of the most significant revenue-generating industries in the world.

It is surprising that South Africa has not claimed its role as a pioneer in one of the world’s largest industries. Strategic initiatives could unlock immense economic potential, cementing South Africa’s position as the global leader in insurance innovation. Picture Cape Town as a hub for international insurance conferences, championed by the Actuarial Society of South Africa, or President Cyril Ramaphosa showcasing the country’s partnership with AIA in diplomatic engagements across Asia. We already have the innovative industry. With just a little more cognizance, the opportunity to leverage that advantage is ours to seize.

Beswick, C. and B. Urban, “Discoverty Ltd: Entrepreneurship in its DNA.” Emerald Emerging Markets Case Studies, 2, 1, 2012.

“Discovery Integrated Annual Report, 2018.” Accessed 22 May 2025: https://www.discovery.co.za/assets/discoverycoza/corporate/investor-relations/iar2018/vitality-group.pdf.

Accessed 22 May 2025: https://www.firstforwomen.co.za/about-us/.

International Financial Corporation, “1st for Women, South Africa — The Case for Insuring Women for a Better Tomorrow.” Accessed 22 May 2025: https://www.ifc.org/content/dam/ifc/doclink/2020/1st-for-women-insurance-gender-south-africa.pdf.

Buthelezi, L. “Naked poised to outstrip traditional insurance model.” Business Day, 10 December 2018.

“Matthew Elan Smith: Co-Founder of Pineapple Insurance, Ep 1.” Blood, Sweat and Ideas Podcast. 14 July 2023. Accessed 22 May 2025:

IBIS World, “Global biggest industries by revenue 2025.” Accessed on 22 May 2025: https://www.ibisworld.com/global/industry-trends/biggest-industries-by-revenue/

Very interesting and original essay. Clearly and succinctly written too.

I enjoyed reading Adam's essay.

Congrats, Adam!