The new weapon of choice

Sanctions almost always fail. Expect more of them.

When Russia invaded Ukraine in February this year, one of the first steps the international community took was to impose economic sanctions. This included things like the US blocking the Central Bank of Russia from accessing more than $400 billion in foreign-exchange reserves, banning the import of Russian oil, gas and coal, and banning all exports of high-tech components to Russia. The purpose was to punish Russia with a deep depression so that they would stop the war and never repeat it.

For those who have not read the news recently, Russia’s war in Ukraine is still ongoing. Although Russian living standards have certainly been affected, the economy has not suffered the strains many had predicted at the beginning of the war. Consider its exchange rate, a rough but relatively easy measure of confidence: As the figure below of the rand-dollar and ruble-dollar exchange rates shows, apart from a blip in March and April, the Russian Ruble remained fairly stable against the US dollar. In short, there seems to be little evidence that the sanctions against Russia – even if these were some of the harshest ever imposed – achieved their initial purpose.

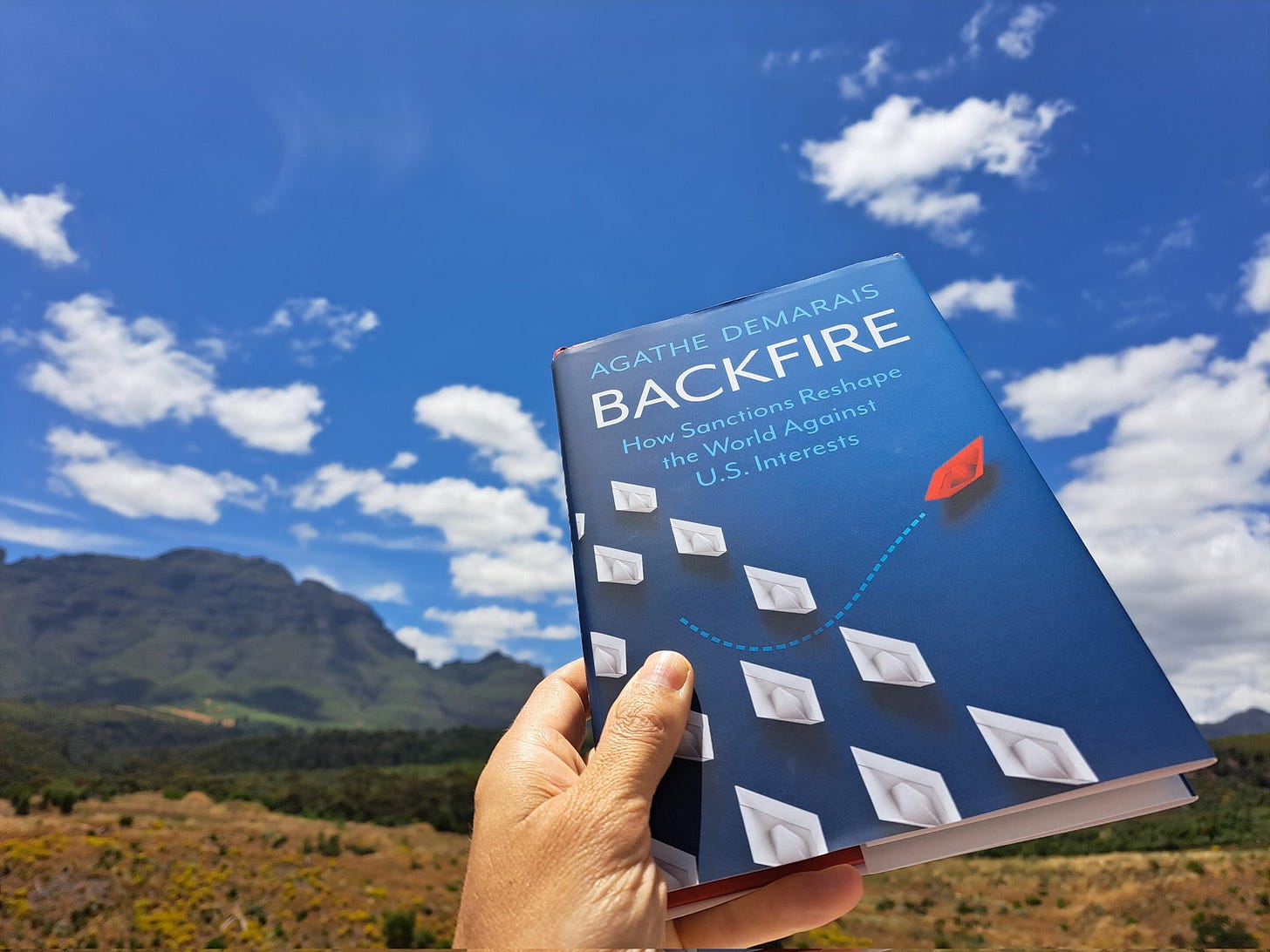

That would not come as a surprise to Agathe Demarais, the author of Backfire: How Sanctions Reshape the World Against US Interests which was published earlier this week. Demarais, the global forecasting director of the Economist Intelligence Unit, has written a damning critique of economic sanctions. They almost always fail to achieve their intended aims, and frequently cause backlash but also collateral damage. Yet they seem to be more popular than ever.

To be fair, there are rare successes. According to Demarais, four factors determine whether sanctions have any chance of success: how long they are in place, whether their goal is broad or narrow, pre-existing trade links, and whether allies join in. She gives the example of US sanctions on Turkey in 2018 to protest the detention of Andrew Brunson, an American pastor. After only two months, Turkey bowed to American pressure and released Brunson. America immediately lifted the sanctions. ‘If sanctions are going to work,’ writes Demarais, ‘they do so fast’. It helped, too, that the goal was narrow, and that Turkey had strong trade links with the US.

But as is so often the case with policy-making, good intentions do not always result in good outcomes. Take the case of the Democratic Republic of Congo. Sanctions were imposed to stop warlords benefiting from illicit mining activities. But the sanctions have caused immense suffering. Says Demarais: ‘As they were drafting their well-meaning legislation, Senator Chris Dodd and Congressman Barney Frank probably had no idea that they would drive up infant mortality in the DRC, thousands of miles away from Capital Hill. Yet the unforeseen effects of the penalties appear to be punishing innocent Congolese families, rather than powerful warlords whose power and fortunes do not seem to shrink.’ DRC today is no closer to peace than before the sanctions.

Southern Africa has examples to boot. Sanctions were imposed against apartheid South Africa in the late 1970s, but it would only be a decade later that the system would finally unravel. As I explain in Our Long Walk to Economic Freedom, the Swedish economist Mats Lundahl had a good explanation for this: Sanctions benefit some and hurt others. If those who stand to benefit have political influence, even if this benefit is only relative, then sanctions may actually prolong the status quo rather than overturn it.

Or take South Africa’s neighbour Zimbabwe. The EU, the US and the UK imposed targeted economic sanctions almost two decades ago. Robert Mugabe’s rule would only be overthrown in 2017, fifteen years later, and by a member of his own political party. Demarais, writing about sanctions against Iran, makes a telling point that applies equally well to the DRC or to the Zimbabwean case: ‘Sanctions often make difficult situations worse for the populations of targeted countries’, rather than the politicians. In fact, this is the point that the AU and SADC recently made in expressing solidarity for Zimbabweans’ two-decade struggle against sanctions. But as the Institute for Security Studies points out, the AU seems to contradict its own policy, as it also imposes targeted sanctions against member states. ‘This wave of support,’ says the ISS, ‘is more about anti-imperialist and Pan-African narratives pushed by Zimbabwe’s government than facts.’ Sanctions are an almost universal phenomenon, and gaining in popularity.

If sanctions are indeed the new weapon of choice globally, then it should also be judged against international law. Under the Geneva Convention, writes Demarais, weapons of war must discriminate between civilians and combatants. ‘The problem with sanctions may be that there are no global rules governing their use. If sanctions lead to the closure of factories and the death of citizens of rogue countries who are unable to access medical supplies, are they much different from other deadly forms of intervention?’

Sanctions are also not uniform. They come in many different shapes and sizes, and tracking their implementation can be tricky. Castellum.AI has compiled a Global Sanctions Index, helping governments understand the risk of sanctions violations and financial crimes in countries. The higher on the index, the more a country is able to fight financial crime. The table below shows the index score for selected countries. South Africa tends to perform surprisingly well compared to its peers.

One sanction that is likely to have global consequences is an export control that restricts China’s access to US technology. In 2019, the Trump administration barred US companies from selling high-tech products to Huawei, a Chinese firm that was the world’s biggest maker of telecommunications equipment. The effects, says Demarais, ‘proved colossal, probably even more than the [US] Commerce Department had expected’.

And these effects are not likely to recede soon. ‘The Sino-American conflict over technology will take place across several decades, probably well beyond 2050.’ The world will likely split in two: global tech firms will need two different sets of supply chains, one for the US and Western countries and one for China and emerging nations. The irony is that in such a decoupled world, economic sanctions, as Demarais so expertly shows, would be even less effective.

History shows that economic sanctions almost never work. Yet we are destined to see more of them in the years to come. Better brace ourselves for collateral damage.

An edited version of this article was first published on News24. Photo by Ryutaro Uozumi on Unsplash. Data by Codera Analytics.

I am shocked. You sound perfectly sensible! Well done. TBH I expected a nutty Neo-Marxian wokester.