South Africa's first financial crisis

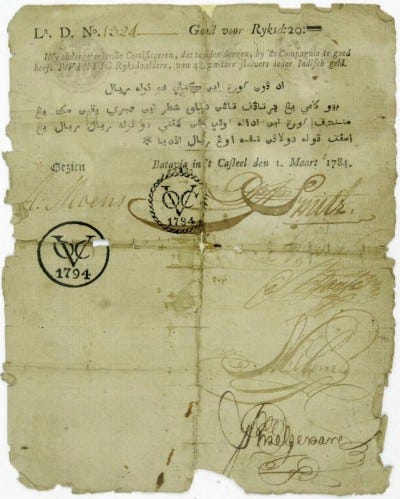

A certificate of credit to the value of 20 rijksdaalders (rix dollars).

It happened much like any other financial crisis: the government was spending more than it could collect, imports outweighed exports, and to combat these twin deficits, the government printed money. Easy money meant that borrowing increased. The exchange rate depreciated, inflation shot through the roof. And with the domestic economy in a bad state, the global economy took a turn for the worse, which meant local lenders, notably a large, unregulated merchant house, defaulted on its debts. A perfect storm.

Though these events sound very familiar, they explain colonial Africa's first financial crisis. In a new ERSA Working Paper, Roy Havemann and I consider the causes of consequences of this 1794 Cape Colony crash. By the 1780s, after a century of settler expansion and relatively high standards of living for the settler population, economic conditions had worsened, largely due to the American War of Independence and the blockade of French ships in Table Bay. Fiscal and trade deficits increased, money was printed, exchange rates depreciated and inflation spiked. But it was an unregulated merchant house, the Gebroeders Van Reenen, that was the tipping point:

By 1780, the Van Reenens had become possibly the wealthiest family in the Cape, thanks to patriarch Jacob van Reenen’s vast landholdings and major involvement in the meat and alcohol trade over several decades. On his death in 1793, Jacob left a number of sons, all of whom rose to prominence in Cape society. The one son, Dirk, built one of the largest and most successful wine businesses. A further two sons, Jacobus Gijsbert and Sebastiaan, went into the lucrative meat merchanting business. Both branches of the family, meat and wine marketers, must have provided merchant credit — however, it was the meat marketers who caused problems.

The Van Reenen brothers had a key advantage: they acted as intermediaries between Cape Town and the far flung districts of the interior, issuing slagtersbriefjes (promissory notes) which could be exchanged in Cape Town and the interior. Because hard currency was regularly in short supply at the Cape, the slagtersbriefjes became the de facto currency. But this allowed for unsecured loans which by the beginning of the 1790s totaled thousands of rijksdaalders. In fact, writing in 1795 to the new British government at the Cape, Johannes Frederik Kirsten complained that “by far the greater part of the Farmers and the Inhabitants of the Town are Bankrupts (sic), the rest have their property under Sequester, and every individual looks forward to impending ruin.” The collapse of Gebroeders Van Reenen would pull down the entire Cape economy.

The policy response during the crisis included fiscal austerity, an attempted reorganisation of domestic financial intermediation and continued monetary easing, which depreciated the exchange rate and created inflation. A new domestic bank was created. Most economic historians regard this bank as a primarily a lending institution, but we show that it also fulfilled central bank functions and had more in common with an emerging group of state-owned banks in Europe and a type of bank created in Amsterdam and Java.

The conventional view of the Cape of that period is that its financial system was substantially underdeveloped in comparison with Europe’s. The crisis shows the contrary, as does the response. Indeed, the system was similar to that of Amsterdam and much of Europe, and the crisis experienced in the Cape was similar to a 1763 crisis in Amsterdam. The Cape, it seems, was a prosperous society with an advanced, albeit informal, financial system.

The crisis had severe implications for economic growth and welfare in the Cape: the exchange rate all but collapsed and, using figures from the GDP estimates Jan Luiten van Zanden and I calculated for this period, per capita GDP fell by 22 per cent between 1788 and 1793. By the time of the first British occupation in 1795, the Cape economy was a shadow of its former self. The policy response was arguably ineffectual and the crisis and the weak response appear to have been contributing factors to the economic stagnation of 1790 to 1820. As the Great Recession of 2007 demonstrated, we remain impervious to the early warning signals of bad weather. Best to learn from the past.

*Image source: Tropenmuseum of the Royal Tropical Institute.